Omni vs Thoughtspot: A Feature Comparison Matrix

Holistics Team

Holistics Team Over the years, we've received over hundreds of RFPs (Requests for Proposal) from a wide range of prospects and customers, from small businesses to international Fortune 500 companies. This has given us valuable insight into how data teams evaluate BI tools, the key questions they ask, and the capabilities they prioritize.

We’ve distilled those insights into a BI comparison matrix and used it to compare today’s leading BI platforms side by side.

Because every team’s priorities look a little different, we’ve also shared a Google Sheet version you can copy, adapt, and use directly with any vendors you’re assessing.

Our approach:

- Facts are prioritized over opinions, no recommendations pushed

- Details are backed by official documentation

- High-level criteria are broken down into specific, measurable sub-points

- Findings are presented in in clear, comparable tables

- Linking to real-world discussions from actual users

We understand we might come across as biased, since we're also a vendor selling BI solution. Rather than claiming neutrality, we'll let the content below speak for itself.

Found an inaccuracy or want your tool added? Use this form.

Feature-by-Feature Comparison Table

| Dimension |  Omni Omni |  Thoughtspot Thoughtspot |  Holistics Holistics |

|---|---|---|---|

| Demo Playground Availability and quality of demo playground for testing the tool before purchase. | |||

| | |||

| Pricing Structure Pricing model and cost structure of the BI tool. | |||

| | ❌ No information available. | User-based or Usage-based ThoughtSpot offers subscription options starting at $25 per user per month, or a usage-based model at $0.10 per query. source | |

| | ❌ No information available. | $140,000/year On average, organizations report paying around $140,000 annually for ThoughtSpot licenses and usage, according to Vendr. source | $9,000+/year Entry plan starts at $800/month. Enterprise plans available for larger teams. source |

| Visualizations Chart and visualization capabilities of the tool. | |||

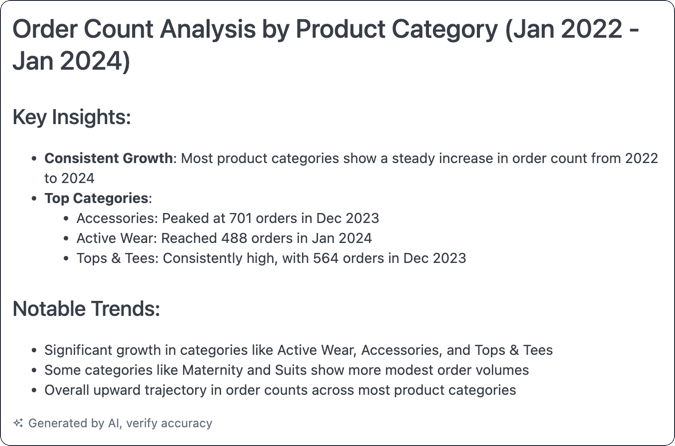

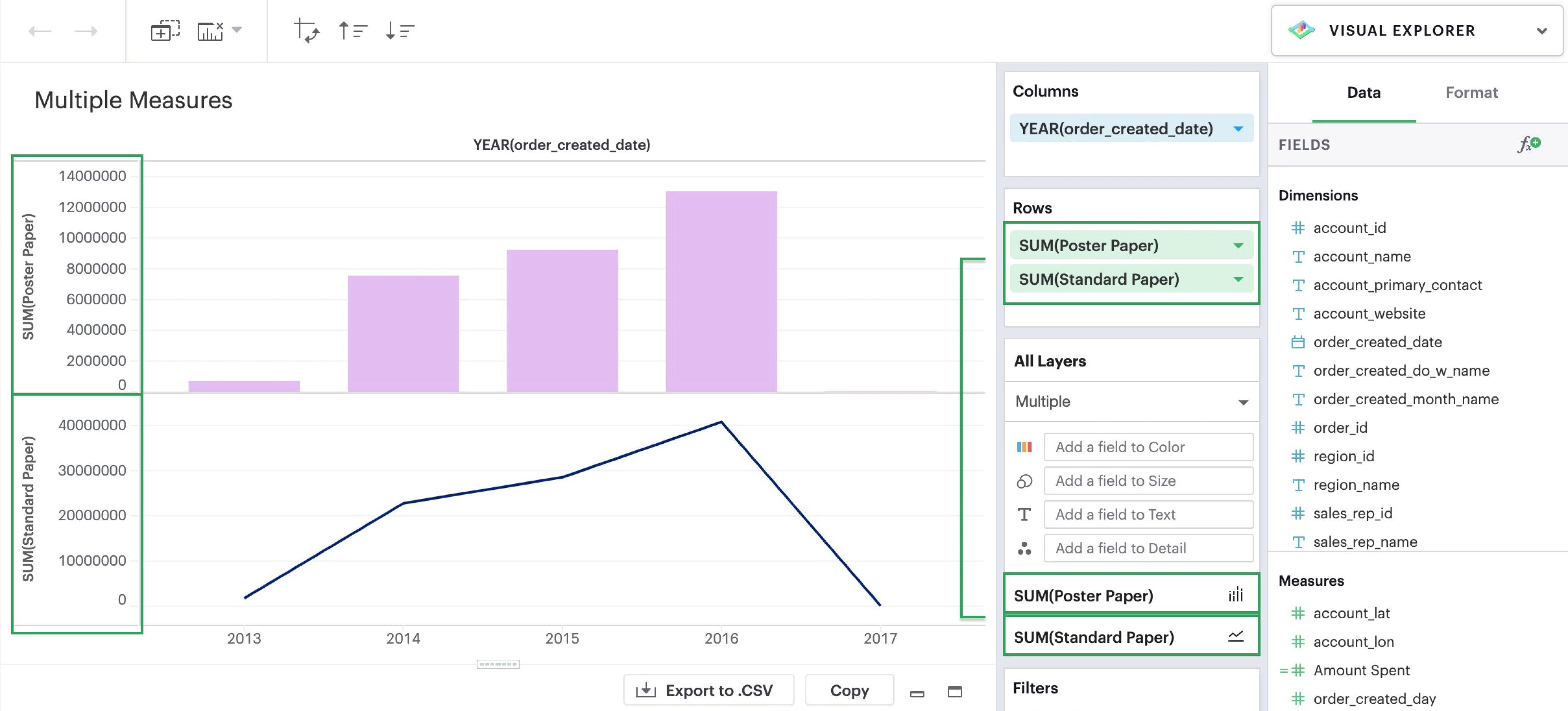

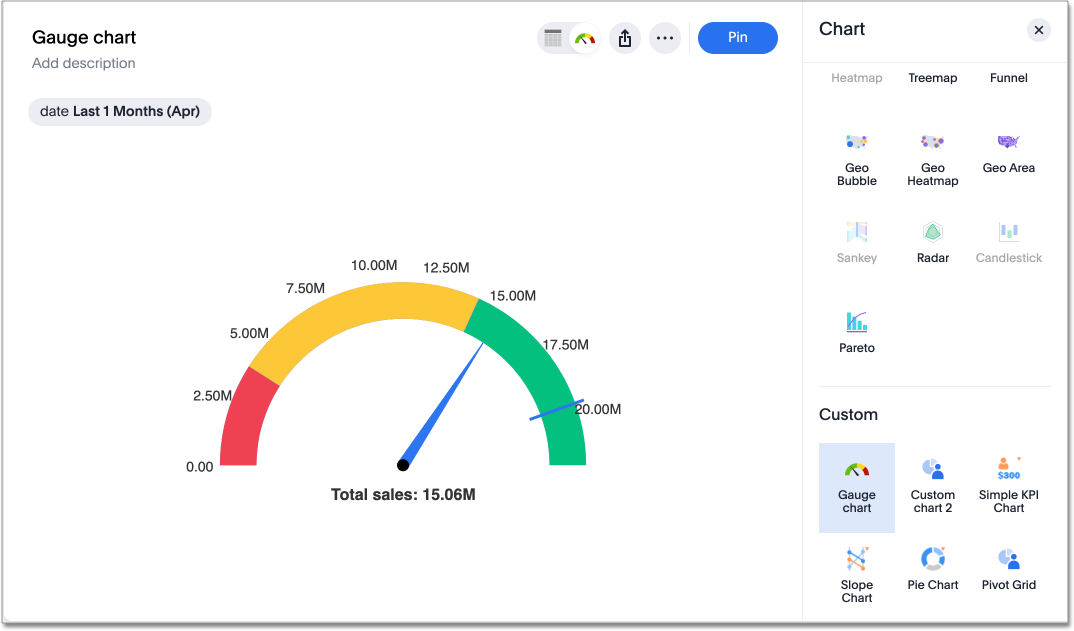

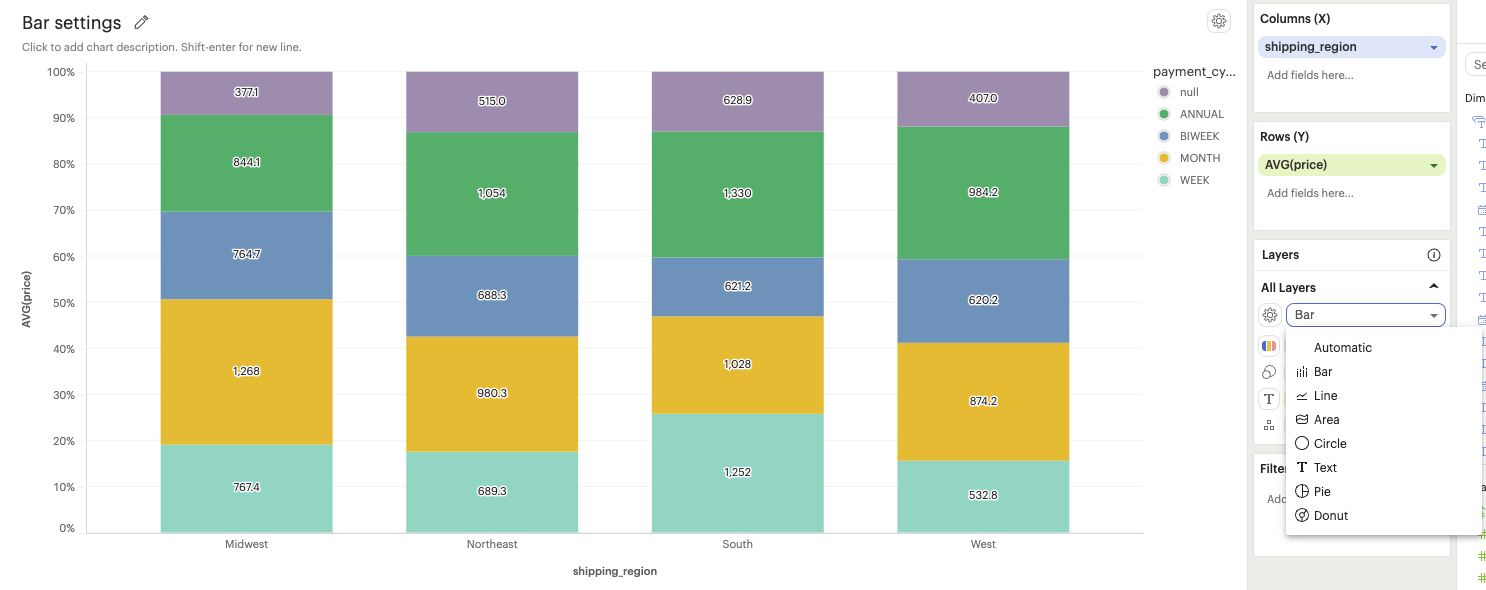

| |  Broad set of native visualizations including AI summary, area, bar, line, KPI, maps, and tables. source |  Multiple measures, faceted groupings, layers, and manual disaggregation capabilities. source | |

| |  Custom visuals via Markdown including iFramed external content like YouTube, Maps, and Twitter. source |  Custom charts are available via Vitara Charts. source | |

| |  On-brand embedded analytics with basic theming controls, full CSS customization not detailed. source | ❌ No global theming or white-label styling documented for native charts. | Custom Theming Comprehensive theming with custom CSS for brand alignment and styling. source |

| | AI Highlights Auto-surfaces insights on Liveboards for narrative exploration and data storytelling. source | ||

| Ease of Use & Self-Service How user-friendly and self-service oriented the tool is for non-technical users. | |||

| | Drill-down, filtering, and ad-hoc exploration directly from Liveboard interface. source | ||

| | Content Discovery Find & manage content with dashboard search capabilities for content discovery. source | Analyst Studio Hub Central hub for organizing reports, Liveboards, and data objects discovery. source | |

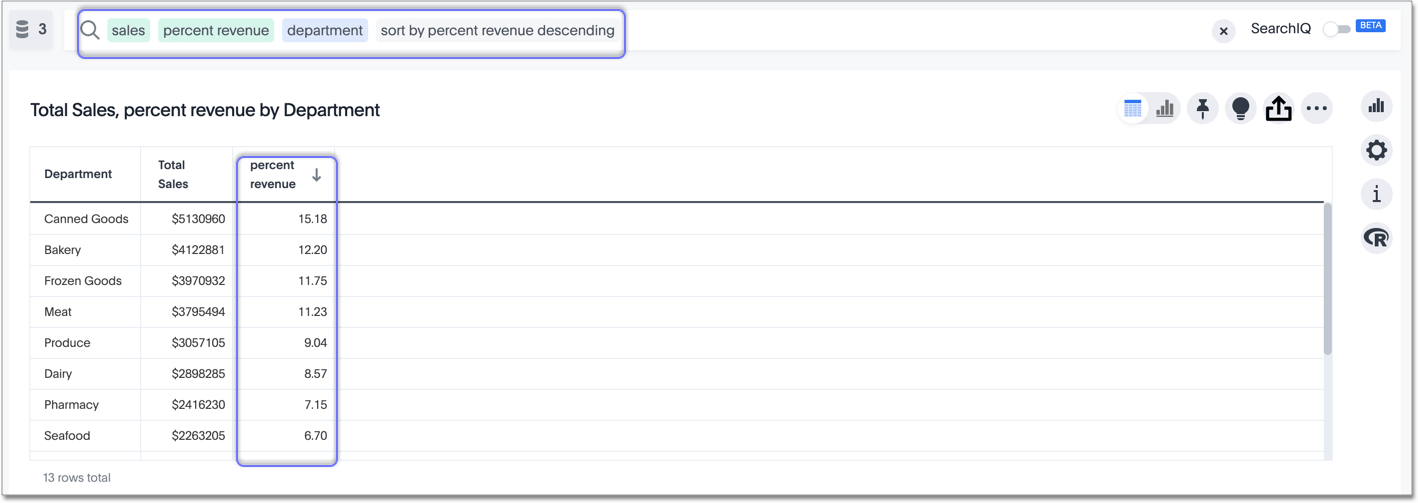

| |  AI-powered table calculations reducing formula friction with smart assistance. source |  Robust set of built-in aggregation functions for custom calculations. source | |

| |  Workbook interface for exploration and building with field picker and model promotions. source |  Layered visuals, mark selection, and drag-and-drop style report building. source | |

| |  Natural language queries with AI assistant for data exploration and insights. source | ||

| Data Delivery How data and reports are delivered to end users. | |||

| | Schedule & Alert Native scheduling and alerting capabilities, specific channels not detailed. source | Scheduled Jobs Schedule Liveboard jobs for automated delivery and subscription management. source | |

| | Governed Sharing Document-level permissions and content sharing with governance controls. source | Secure Sharing Internal RBAC sharing and external distribution with multiple export formats. source | |

| Embedded Analytics Capabilities for embedding analytics into other applications. | |||

| |  Dedicated embed capabilities for customer-facing reports with on-brand integration. source | Visual Embed SDK Embed Liveboards and visualizations via SDK with event handling capabilities. source | Iframe + API Basic dashboard embedding and self-service embedding for report creation. source |

| | On-brand embedded analytics with AI assistant branding controls, full theming API not detailed. source | Customization framework Teams can whitelabel and customize ThoughtSpot embedded using style customization framework and custom CSS. source | |

| | Customer Self-Service Customers can build customizable dashboards and natural language queries within embedded product. source | ❌ No information available. | Self-Service Embedding Embedded users can create and edit their own reports and dashboards. source |

| Reliability & Performance System reliability, performance optimization, and monitoring capabilities. | |||

| | Caching Controls Admin and user caching controls with visualization performance improvements. source | ❌ Not available. | |

| | Admin Analytics In-app workbook analytics for administrators to monitor usage and system efficiency. source | ❌ No information available. | |

| Semantic Modeling Data modeling and semantic layer capabilities. | |||

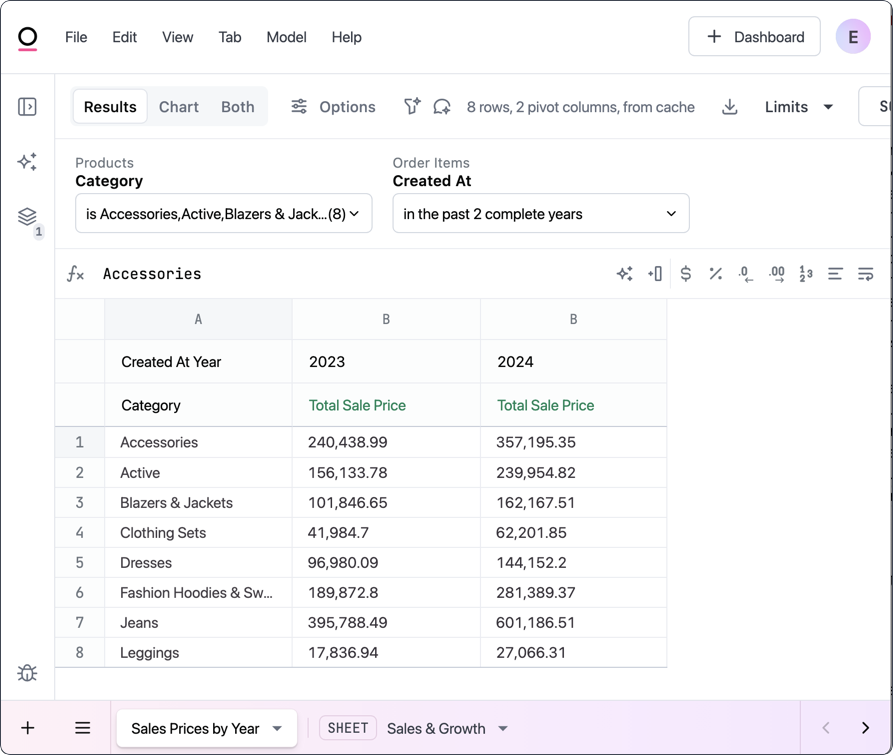

| |  Workbook queries become reusable model views with parameters and governed topic management. source | Spotter Model Readiness Column naming, synonyms, indexing guidance for semantic model context. source | |

| |  Branch mode for safe changes with Git integration for versioned development workflows. source | Git Integration Data teams can govern Liveboards, Answers and TML changes via Git Integration. source | |

| |  Early implementation of dbt Semantic Layer integration, marked as work-in-progress. source | ❌ No information available. | |

| | ❌ No information available. | ||

| Security and Governance Security features and governance capabilities. | |||

| | Role-Based Permissions Multiple permission roles including Restricted Querier, Modeler, Connection Admin, and Organization Admin. source | SSO Authentication Link sharing requires authentication via sign-in or SAML integration. source | |

| | ❌ No audit logs or compliance documentation available in provided materials. | ❌ No information available. | |

| | ❌ No data masking or encryption features documented in provided materials. | ❌ No information available. | |

| | AI Data Security Dedicated AI data security configuration, general monitoring/logging not detailed. source | ❌ No information available. |

Community Discussions

Discover what other practitioners are discussing about this topic.

Wondering if anyone came across a BI tool that impressed them a lot in terms of features, ease of use, scalability, etc.

Been looking at tools such as evidence.dev, Rill, streamlit, some others and wondering others perspective on it, is it any good? Types of vizualisations available, end-to-end BI process improved or added headache?

Power BI. If you know what your doing with that tool and Azure you shouldn't need a dozen other tools. It is dominating the quadrants. It is cheap. Paginated is now included in Pro.

Dwh, measures in dax, blob storage compatibility, great visualization, can migrate cubes to it, etc.

Tableau is not getting investment, others are either immature, dying, recreating the wheel....

To me then reasons why PBI rocks are: DAX Third party tools (dax studio, tabular editor) Complex data modeling Deneb and other custom visuals Integration with the Microsoft stack / power platform/ excel The Italians/ Patrick

I have heard that tableau offers: Easier or quicker reads of data over power bi (especially over a million records) More natural integration with AWS and Sagemaker Easier to make visuals

Am I missing anything?

My Org. Is currently transitioning from Tableau to PBI. Having used Tableau for the past 3 years I will say it’s more snappy with throwing measures on a chart to do quick analysis. Also building dashboards appear to look nicer than PBI. But having to create a new sheet for every visual can become a pain with data heavy dashboards.

As I am learning PBI, I feel getting data to join is easier in PBI. Not having to do power query in excel then load into tableau to build a data source. Where it all lives within PBI. Although DAX is intimidating, I am starting to understand the logic behind it.

The biggest weakness in Tableau right now, as I see it, is that it is owned by Salesforce. I have no confidence that they can modernize Tableau.

The biggest weakness in PBI it's its visuals. The GUI is very clunky.

Looker is a BI Platform whereas Tableau (Ive not used PBI) is a Visualization tool.

They serve different purposes imho. Tableau does not allow much flexibility when it comes to ad-hoc reporting. A Tableau best practice is to not build dashboards on datasets with more than a handful (20 or so?) attributes, whereas Looker has the concept of 'Explores' that can contain hundreds of attributes for the end user.

A company that only uses a visualization tool like Tableau really limits who has access to pull reports. People at my company complain so much about Looker and they want Tableau but what they don't realize is that if we had Tableau, they likely would not have a developer license and they would have to give their reporting/dashboarding requirements to a BI Developer to create their reports. For small companies that can really create a bottle neck and the average business end user likely doesn't know enough SQL to explore the data.

Semantic layer of using LookML rocks. Visualization piece not so much. Compared to tableau is lacks a lot.

Can someone suggest some other alternatives that can help us.

Sounds a lot like us. Legacy environment:

- multiple BI tools / multiple data warehouses

- QlikView: 340 dashboards, 2k+ daily tasks, ETL in Qlik script

- Moving to: 5Tran, Snowflake, dbt, PowerBI

Observations:

- Qlik script skillset is highly transferable to snowflake SQL.

- Snowflake is a columnar database, like Qlik, and like Qlik you do not have to worry about traditional database concepts like indexing, record locking, performance, etc. Your Qlik developers might find it difficult to find noticeable differences between Qlik script/qvd and Snowflake SQL/snowflake tables beside the obvious syntax differences.

- MSnowflake has all functionality of Qlik script (we did HEAVY ETL transformations in Qlik), and it adds capability like better data insert/merge, and recursion, etc. Some geospatial functionality that looks very similar to Qlik geo analytics which we also use heavily. Obviously, snowflake adds all the new generation of cloud data warehouse capabilities like ingesting different cloud data formats.

Tips:

- Ensure your leadership understands that cloud means renting their infrastructure. Cost is the biggest pain point of my approach-but it was the choice of our leadership team. On premise to cloud is a big transformation, make sure you know what that means.

- Separate the data warehouse and BI layers, and build good models. Note: Qlik is less picky than other tools about the model because of its associative data models. PowerBI technically works with any model, but you’ll see its best with a star schema. Also, this separation between data and presentation will allow flexibility in future tool changes.

Late to the party, and someone has already mentioned, but I’d like to vouch for Holistics, Sigma and Omni.

They are all decent BI tools, but if you’ve got heavy ETL needs like you did with QlikView, you’ll probably need to add a dedicated ETL tool into the mix. Something like Alteryx or Azure Data Factory could fill that gap.

I would prefer to keep both tools alive, Tableau for fancy executive type and complex dashboards, and use Looker for self-service. However leadership needs a bigger yacht so we have to cut costs, one has to go. Can’t do Power BI, we are a G-suite company.

What do you think about my view/assumptions? How would you decide which tool to pick if any?

First of self serve BI is a myth. Second I assume your IT infrastructure can handle either option.

If you want great visualization, drill downs then Tableau is the way to go. If you are in the google ecosystem and also need some ML stuff then looker. Can also look at the volume licensing structure. I would suggest going with one rather than both. Maintenance costs would eat you alive.

Relatively new to Looker development (6 Mos and LookML certified), and nothing seems to work as well in Looker as it did in my old job in Tableau - except the crazy ass sql that can be written by clicking in a well curated explore. Looker Data Studio Pro could satisfy your Tableau hungry people (not as good as Tableau, but it's got more viz capabilities than Looker). It seems those awesome days of analysts building amazing tools, but also holding the keys to the information are numbered if not already gone. Embrace the future as disappointing as it is.

Looker's big advantage, as it's always been, is its semantic layer. It's easy there to map out hugely advanced and complex datasets in ways that then make visualization easier. It's really built as a nice semantic layer that happens to do visualization.

Tableau is kind of the opposite. Tableau sucks at actual data stuff... Managing the data, joining it, building reusable measures, etc... tableau sucks for that stuff. But Tableau makes pretty pictures.

So you might want to think about what matters to you and your users over time.

Seems pretty straight forward - get rid of Looker and make the few users who are using it change to Tableau.

You may have a lower subscription cost for looker, but you need to hold that recurring savings up against the cost of change for your tableau setup: Report migration, change management / re-training of existing user-base, dual licensing during migration period, setup of integrations, etc.

How far out is your breakeven point then on a pure cost / savings basis?

After that you have to consider that in all likelihood, your report migration will not just be a migration but a report change, in cases where Looker can't produce the same visuals etc. as Looker. That's going to add an extra element of stuffing looker down people's throats to get a worse looking product (report) than they already had.

I hope that break-even point is in the near-future. Then you can of course argue that with Looker being part of the google product suite, you've got some architectural benefits and licensing benefits and maybe some machine learning awesomeness you can make use of, potentially... down the line... if it turns out to be useful...

So without knowing your specifics, you'll need to make a pretty strong "architectural " case in addition to your business case. In addition you can possibly argue for a "process optimization" / "time to delivery" case, by having a single platform within the company for people to build expertise in. Basically saying "we're placing all bets on G-suite including BI, that's the direction, your reports may end up looking a bit worse, but we'll save money and streamline our BI process in the mid-term, and long-term we think it'll be a better product".

Haven't heard of Domo but if the Gartner Magic quadrant is considered a good measure then it's a way behind Micrososft.

https://www.domo.com/learn/report/domo-named-a-challenger-in-2023-gartner-magic-quadrant

I'm always suspicious of vendors that say "contact sales for pricing". Any idea what the cost is for licencing? Looks llike you need to write some SQL to connect to data source.

Domo's Marketing strategy involves getting their salesmen in the room with C-Suite execs and keeping "technical people out of the room until we're talking about implementation".

I'm currently with a company that paid a small fortune for domo and it's almost universally hated by everyone. The analysts have to spend hours trying to get it to work, datasets collapse regularly under the weight of compute. It's absolutely not intuitive, the native MONITORING suite is an app you have to install from the marketplace.

At its best, it's a way to go get an excel export. We're currently trying to transition away from it and one of the lead contenders in the meanwhile is PowerBI.

There are countless BI platforms out there, but Tableau and Power BI are the dominant players — as you can see from Google Search Trends chart pictured here, Power BI has seen steady growth, and search volume has surpassed Tableau — the reason for this change has multiple causes:

1. Tableau interest peaked with the SFDC acquisition and then stagnated — it’s likely leadership, marketing, and business changes led to this.

2. During the start of the COVID pandemic, we saw a steep decline in Tableau interest, whereas Power BI only experienced a temporary dip. Both orgs rebounded in Feb 2022. However, Power BI search volume has continuously surpassed Tableau since that time.

3. Post-pandemic, what was going on? Microsoft’s marketing and sales machine continues to hammer their “Fabric” data infrastructure — Azure, Power BI, etc. If a team was migrated to Azure for their data warehouse, Power BI becomes an upsell. During higher interest rate times, savvy teams are auditing their entire tech stack, and analytics tools like Tableau are no exception. Leading data and IT teams are exploring build vs buy for self-serve analytics and long-term growth. For many enterprises already on a Microsoft stack both for 365 and Fabric, it’s natural to evaluate Power BI —

4. The Salesforce roadmap with Tableau remains lose and uncertain — people are speculating Tableau will be rolled into SFDC and at some point, but there is no clear and public plan — enterprises investing millions in their data stack and 5–10 year tech stack road map do not like uncertainty.

This helps reinforce what we all know: Salesforce killed Tableau (so far).

Also, Tableau is materially more expensive. As they become closer to parity, more companies are going to choose PBI because BI is not revenue-generating (technically). Half the price is a no-brainer unless your usecase is ONLY supported by Tableau.

<br. Honestly, Microsoft should just spend what it takes to match Tableau for viz specifically. Then charge 15-30% more. They would bury Tableau forever because the lack of visual customization is really the only concrete thing Tableau is still significantly better at.

Tableau calculated fields are way more intuitive and simple than DAX. They cannot accomplish everything DAX can, but almost everything. And for the things it can't, it's almost niche.

Still, both tools are quite good though.

I realised that in Power BI I can't write SQL queries directly, I can only connect directly to the database tables and do the transformation inside Power BI. A workaround would be to write sql queries separately and create a view in my db and then connect power BI to the view to create a dashboard.

I want to ask for your opinions on this. 1. Should I move to a tool where I can write queries and make visualisations. 2. Use views with power BI. 3. Simply abandon SQL queries and just do transformations entirely in power BI.

You can write sql queries directly in power bi, in the option to import or direct query, extend the window and you can write there. Use it for import or direct query.

I advise building views anyway for reusability and maintainability outside of Power BI desktop app. Im sure Tableau has similar options.

Take into consideration how your end user interacts with the final product and if the aesthetics of one tool or another increase adoption. Those pretty charts are worthless if no one in the company leverages their insights.

For some reason every time I started at a new place, I was thrown right into the BI evaluation process. Having gone so far down the rabbit hole, here are the tools that really impressed me.

- Holistics (we use this)

- Looker

- Sigma

- Hex

Hex is more of a notebook-style tool. It’s really fast, perfect for exploratory analysis.Sigma is spreadsheet-focused, so I imagine finance folks (or any Excel lovers) would find it particularly intuitive, plus it's got solid visualization features.

Looker is an old favourite around here, you'll see plenty of love (and sometimes hate) for it in this sub.

Holistics builds on the ideas Looker established, where data team defines the relationship between tables and how metrics are calculated on a semantic layer, and then everyone else can use the tool to build their own reports. What I really like is how they’re innovating where Looker is lacking, like with their visualizations. They've got this "dashboard as code" feature that opens up a lot of creative possibilities for dashboard designs.

Superset has been a fantastic BI tool in our company as an alternative to Tableau or Looker.

Since it is free and fully open sourced it has been great to have our R+D team extend and embed it within our own product, and also empower the BI team to create custom dashboards to replace default ones for enterprise clients.